Maximum Social Security Tax In 2024. For earnings in 2024, this base is $168,600. It’s $4,873 per month in 2024 if retiring at age 70 and $2,710 if retiring at.

That’s what you will pay if you earn $168,600 or more. (more if you wait until 70).

We Call This Annual Limit The Contribution And Benefit Base.

In 2024, the maximum amount of earnings on which you must pay social security tax is $168,600.

What Are The Maximum Social Security Wages For 2024?

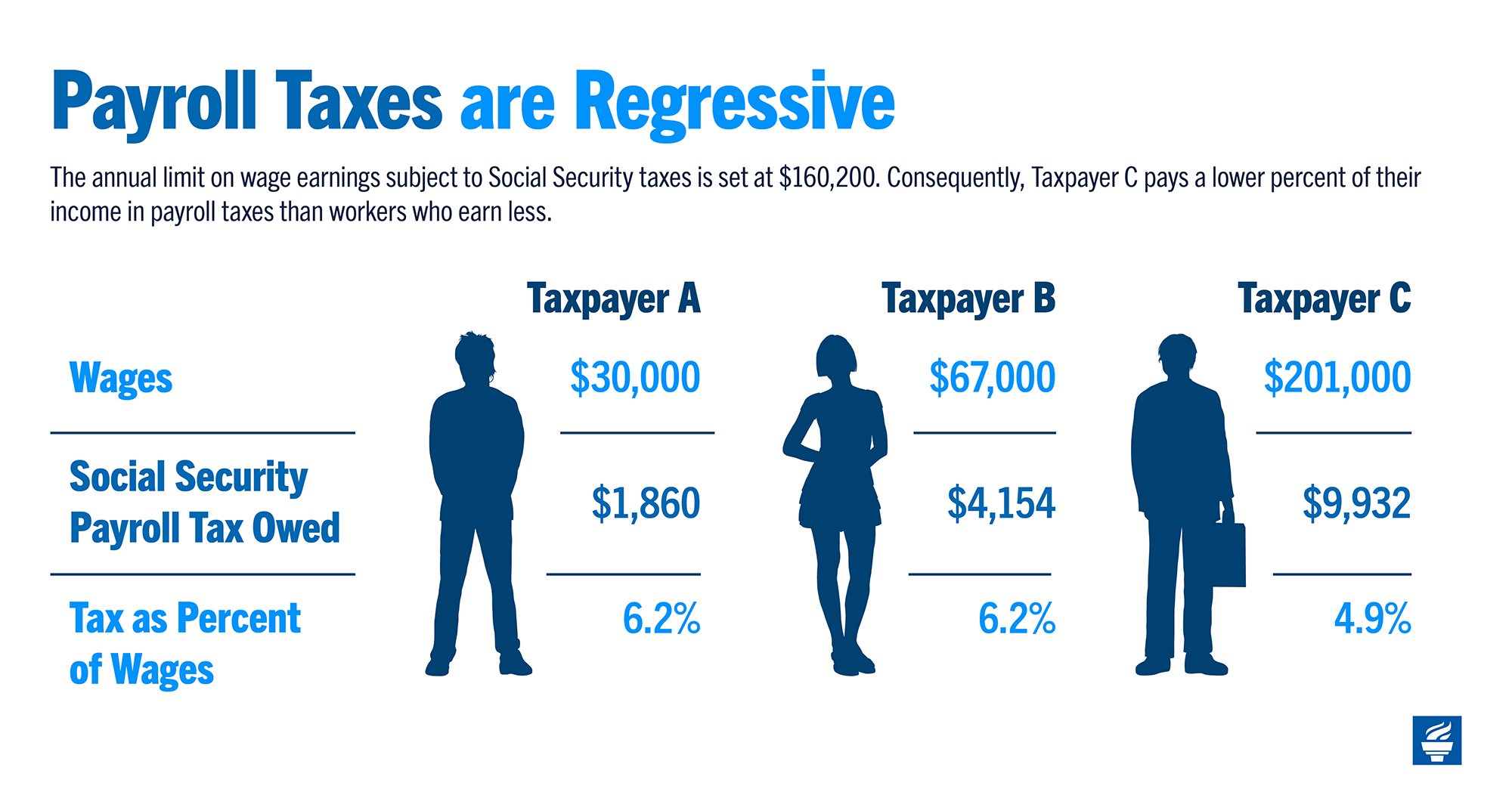

In 2023, workers paid social security taxes on income up to $160,200.

In 2024, The Maximum Social Security Benefit Is $4,873 Per.

Images References :

Source: www.pgpf.org

Source: www.pgpf.org

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. For 2024, the social security tax limit is $168,600.

Source: www.thestreet.com

Source: www.thestreet.com

How Can You Get the Maximum Social Security Benefit? TheStreet, What is the maximum possible social security benefit in 2024? For 2024, an employer must withhold:

Source: www.918taoke.com

Source: www.918taoke.com

社会保障策略为更好的退休财务武士亚博app下载, For earnings in 2024, this base is $168,600. For 2024, an employer must withhold:

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Social Security Tax Definition, How It Works, Exemptions, and Tax Limits, In 2023, workers paid social security taxes on income up to $160,200. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi) payments in 2024.

Source: jackquelinwgratia.pages.dev

Source: jackquelinwgratia.pages.dev

Social Security Limits On 2024 Kania Marissa, The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. What is the maximum possible social security benefit in 2024?

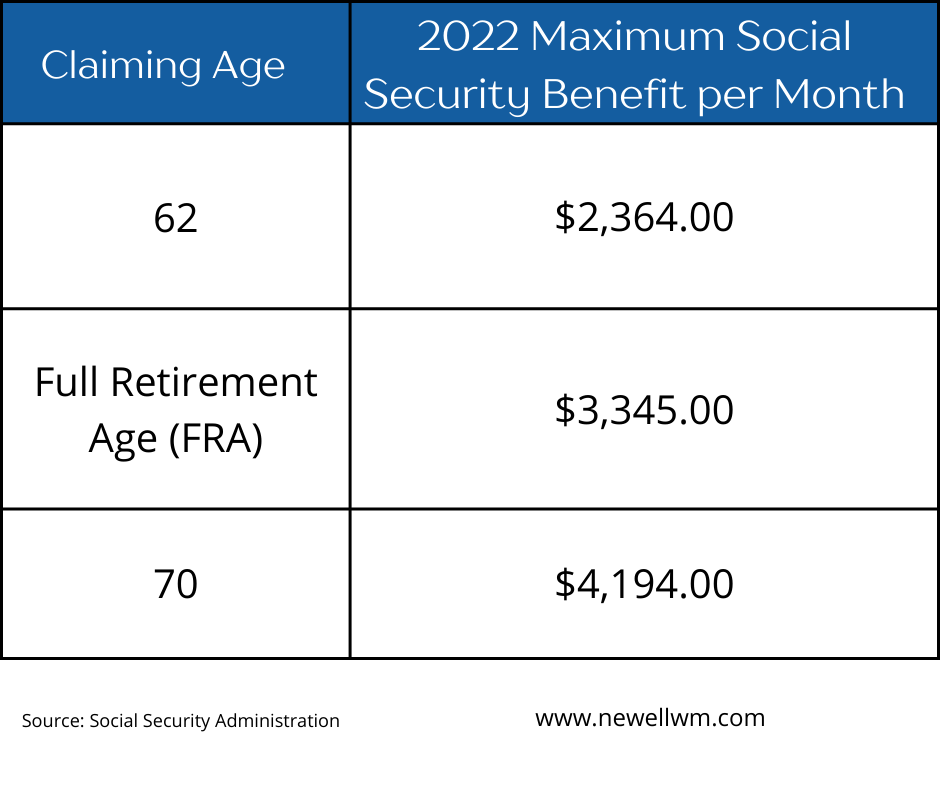

Source: newellwm.com

Source: newellwm.com

How Much is Social Security? Newell Wealth Management, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. What is the maximum possible social security benefit in 2024?

Source: flipboard.com

Source: flipboard.com

Calculating the maximum Social Security tax you can pay Flipboard, The highest social security retirement benefit for an individual starting benefits in 2024 is $4,873 per month, according to the social security administration. For earnings in 2024, this base is $168,600.

Source: cahraqanastasie.pages.dev

Source: cahraqanastasie.pages.dev

2024 Ssdi Earnings Limit Sharl Natalina, The amount you receive in social security benefits each month will have an impact on your overall retirement budget. For employees, the maximum social security tax in 2024 is the product of the tax rate (6.2%) and the maximum taxable earnings ($147,000).

Source: www.the-sun.com

Source: www.the-sun.com

3 steps to get the maximum 3,895 social security benefit each month, The most you will have to pay in social security taxes for 2024 will be $10,453. For earnings in 2024, this base is $168,600.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Maximum Social Security Tax in 2021, We raise this amount yearly to keep pace with increases in average wages. What is the maximum possible social security benefit in 2024?

The Maximum Wage Subject To Social Security Tax Has Gone Up.

I.e., 6.20% × $168,600), plus;

6.2% Social Security Tax On The First $168,600 Of Employee Wages (Maximum Tax Is $10,453.20;

For earnings in 2024, this base is $168,600.